Introduction to Part 2: The Selloff, Ownership Process, and Aftermath

First off, this blog post is the second post in a series of two posts about Blackstone’s 2007 buyout of Equity Office Properties. The first post can be accessed via the following link:

In this post, we’ll delve into the massive, historic selloff of office buildings which were owned by EOP at the time of Blackstone’s acquisition of EOP. Specifically, we’ll account for every property that Equity Office owned at the time of Blackstone’s acquisition including the prices at which Blackstone subsequently sold the assets, which properties Blackstone immediately sold and which it held onto, which investors acquired each asset, and how each property sale was a strategic move by Blackstone, chipping away at EOP’s bulky portfolio to sculpt a masterpiece consisting of trophy properties, at a resulting bargain price.

Completing this comprehensive property-by-property analysis, required first reviewing EOP’s 10K financial statements from the end of 2005. The 10K financial statement included a routine section specifying the annual depreciation and depreciable basis for each of EOP’s real estate holdings. This list provided a comprehensive view of every single one of EOP’s properties at the end of 2005. Next, I reviewed quarterly statements for the first, second and third quarters of 2006, which contained sections specifyng the buildings which were acquired and sold during those quarters. This tailored list was about as close as I was able to come to a complete list of all of EOP’s office buildings at the time of Blackstone’s acquisition of EOP on February 9, 2007.

The Selloff

The story of Blackstone’s selloff of EOP’s office buildings begins before Blackstone finalized its acquisition of EOP. As part of the negotiations with EOP, when Blackstone agreed to increase its offer for EOP, Blackstone gained permission to begin discussing some of EOP’s specific properties with potential buyers. Blackstone receiving this concession likely played a role in Blackstone being able to raise its offering price to $39 Billion, as it was able to line up buyers for many of EOP’s assets at higher prices than it initially forecasted.

Blackstone knew it had to sell most of EOP’s properties to pay down the almost $35 billion of debt it was taking on as part of this acquisition, as entering a recession with an over 90% loan-to-value would be extremely risky. Having received EOP’s permission to discuss EOP’s properties with outside investors, Blackstone went as far as lining up a buyer to acquire several of EOP’s office buildings simultaneously with Blackstone’s closing.

Sale of New York City Office Buildings to Macklowe Properties

On February 9, 2007, simultaneously with Blackstone acquiring EOP, Macklowe Properties acquired eight of EOP’s Manhattan office buildings for $7 billion. EOP’s Manhattan office buildings included in the sale totaled 6,600,000 SF, which equates to a price of over $1,000/SF, and a cap rate of about 3.6%. The astronomical price of the sale beat Blackstone’s expectations and was one of the highest valuations ever achieved in Manhattan based on numerous measures.

8-building EOP Manhattan portfolio which was acquired by Macklowe Properties

At the time the opportunity was presented to Macklowe Properties, Harry Macklowe was feeling invincible after the General Motors building he acquired in 2003 for $1.4 billion was now worth $2.8 billion. Furthermore, Macklowe had experienced similar rates of price appreciation on several other Manhattan properties, and was therefore understandably excited when the rare opportunity to acquire eight Manhattan office buildings was presented to him.

In acquiring the transaction, the widely-respected and experienced investor Harry Macklowe reportedly completed the acquisition on short notice, without sufficient time to complete due diligence, and with an unbelievable 99% loan-to-value. In acquiring the Manhattan Portfolio in a record-breaking transaction, Macklowe invested just $50 million of equity while borrowing about $6.95 billion of the total purchase price. The multiple loans obtained by Macklowe amounted to an all-in bet, where Macklowe would be collateralizing not just EOP’s eight office buildings but also all of his other real estate and personal possessions.

Interestingly, throughout its buyout of EOP, Blackstone never owned these eight Manhattan office buildings, never took title to these properties and transfer taxes were only paid once (as opposed to being paid twice from a sale to Blackstone and a subsequent sale Macklowe). Macklowe Properties’ funds for the purchase were wired into escrow while Blackstone was acquiring EOP, and Macklowe simply took ownership of these properties directly from EOP.

Most people think that Blackstone acquired about 100 million SF of office buildings for about $39 billion (about $390/SF), but Blackstone basically acquired about 93 million SF of office buildings for about $32 billion (about $344/SF). Furthermore, when we consider that Blackstone sold about 2/3rds of EOP’s portfolio within six months of its acquisition, this pattern of Blackstone continuously decreasing the price per square attributable to its retailed EOP properties will become increasingly noticeable.

Sale of Atlanta Office Buildings to Barry Real Estate Companies

In a sale that was reported on February 5, 2007, and likely closed a short time after Blackstone’s February 9th acquisition of EOP, a joint venture of Barry Real Estate Companies and Rubenstein Partners acquired EOP’s Atlanta portfolio. EOP’s Atlanta portfolio included about 5 million SF, consisting of a mixture of “Class A” office buildings along with redevelopment opportunities in up-and-coming parts of Atlanta. The sale price was approximately $200/SF for a total of $1 billion.

This portfolio was initially listed for sale by Sam Zell-led EOP during September 2006, as part of its continued strategy of selling off EOP’s assets in smaller, secondary markets, and continuing investing in trophy properties in core markets.

Just like almost every other portfolio sale from EOP’s portfolio, this acquisition by Barry’s Real Estate Companies catapulted the buyers to an indisputable position at the top of the local real estate market. EOP’s office portfolio consisted of an approximately 50/50 mixture of Class A office buildings and other properties that were ripe for development and redevelopment as urbanization would continue for many neighborhoods in Atlanta where EOP owned older, underperforming properties.

Sale of Seattle Office Buildings to Beacon Capital

Within a week of Blackstone’s acquisition of EOP, Blackstone reached an agreement to sell about 11 million SF of Class-A office buildings in Seattle and Washington D.C.to Beacon Properties for about $6.35 billion. The office portfolio included Columbia Center, the tallest building in the Pacific Northwest and many other Class-A properties.

From Blackstone’s perspective, at almost $500/SF it certainly made sense to sell the Seattle and Washington D.C. assets. The Seattle office market is heavily dependent on Amazon’s demand for space, which at the time was a risky, unprofitable business to be depending on for the success of a multi-billion dollar office investment. Likewise, the office market in Washington D.C. is highly reliant on federal funding for government agencies which could not be completely relied on if there was a recession or if there was a major cut to government funding due to a new president from the upcoming 2008 election, or any other reason.

Sale of Portland Office Buildings to Shorenstein Partners

In a sale reported less than a week after Blackstone’s acquisition of EOP, on February 13th, 2007, Blackstone sold EOP’s Portland-area office buildings to San Francisco-based Shorenstein Partners. The sale included 46 assets totaling over 4 million SF of office buildings and was obviously well underway before Blackstone closed on its acquisition of EOP. Shorenstein partnered with the Yale Endowment Fund among other investors, and the transaction was financed at a 65% loan-to-value, which means the $1.13 billion consisted of a down payment of approximately $395.5 million and a loan amounting to about $734.5 million.

As reported in the Oregonian, the deal instantly catapulted Shorenstein Partners to the top of the Portland office market, even though the transaction also signaled Shorenstein Partners’ first acquisition in Oregon. The transaction was also the largest real estate transaction in Oregon history, with the value of this transaction amounting to 5 times the amount of the routine annual office building sales volume in Portland.

Sale of San Diego Office Buildings to The Irvine Company

On February 15th, 2007, within a week of Blackstone’s acquisition of EOP, news outlets reported that The Irvine Company had reached a deal to acquire 17 San Diego office buildings totaling about 2.1 Million square feet for an amount estimated to be $1,000,000. Based on the purchase, the cap rate was estimated to be in the low 4% range with the buildings approximately 89% occupied at the time of sale. All but two of the office buildings were located in the University Town Submarket near La Jolla, CA. A local real estate broker commenting on this transaction described the news of the transaction as “the most powerful news we’ve had in San Diego office market history.”

Sale of Orange County and Los Angeles Office Buildings to Maguire Properties

On February 20, 2007, EOP’s Orange County and Downtown Los Angeles office buildings were sold to Maguire Properties in a $2.85 billion transaction. The transaction consisted of 24 office buildings totaling over 8 million SF. The portfolio of properties were described as “trophy quality properties” which were 91.8% leased at the time of sale.

In acquiring EOP’s Orange County and Downtown Los Angeles portfolio with a large amount of financing, Maguire cemented its position as the highest leveraged publicly-traded office REIT, a position that would expose Maguire Properties to significant risk and financing issues during the upcoming recession.

Sale of Denver Office Buildings to Callahan Capital Partners

On February 22nd, 2007, Blackstone sold EOP’s Denver office buildings to Callahan Capital Partners for an estimated price of $800 million. The price amounted to a bit over $300/SF for the 2.7 million SF portfolio.

Timothy Callahan, principal of Callahan Capital Partners, previously served as the CEO of Equity Office Properties until 2002, before leaving to head Trizec Properties. After four years at Trizec Properties, Blackstone acquired Trizec Properties in early 2006, and now Callahan was already embarking on his next venture and acquiring properties he was in control of just five years earlier as CEO of Equity Office Properties. This sequence of events goes to show the small world of REITs and billion dollar real estate investing.

Sale of San Francisco Office Buildings to Morgan Stanley

On February 26, 2007, Blackstone sold ten of EOP’s Downtown San Francisco office buildings to Morgan Stanley for $2.8 billion. The purchase price of the approximately 4 million square foot portfolio amounted to about $650-700/SF. With this single transaction, Morgan Stanley became the largest office landlord in Downtown San Francisco, surpassing Beacon Capital and Shorenstein Partners, the next two largest owners.

Considering that the average asking rent in the Downtown San Francisco submarket was $37/SF/Yr at the end of 2006 (which was up for $27/SF in 2004), the 1st year return on Morgan Stanley’s purchase was likely under 4%, and possibly as low as 3%. In the very supply-constrained San Francisco office market, it’s not unlikely that an institutional investor such as Morgan Stanley would jump at the opportunity (and pay well above market value) to acquire a sizable portfolio of 10 office buildings which it could hold long-term.

Blackstone definitely understood the strong real estate fundamentals in Downtown San Francisco (very constrained supply and high demand), but they probably couldn’t justify holding onto the buildings after receiving Morgan Stanley’s “Godfather offer.”

Sale of Connecticut Office Buildings to RFR Realty

On March 28, 2007, Blackstone sold EOP’s Stamford, CT office buildings to RFR Realty, a New York City based investment company. The price for the 1.6 million square feet of office buildings was reported to be $850 million or about $520/SF.

Interestingly, Stamford, CT is located near the border of New York and Connecticut, just 30 miles away from Manhattan and within view of Long Island. Therefore, it’s not surprising that rental rates for the seven-building Class-A building portfolio ranged from approximately $40/SF/year to over $50/SF/year. Just to compare, Blackstone sold EOP’s Downtown San Francisco assets at a price of $650/SF with market rents of $37/SF, a gross rent multiplier (based on market rents) of about 17.5. This compares to a gross rent multiplier (based on market rents) of about 10 for the Stamford Portfolio, and just goes to show how low of a return Morgan Stanley was willing to settle for to acquire the San Francisco Portfolio relative to some of EOP’s other well-located properties.

Sale of Austin Office Buildings to Thomas Properties Group

On March 29, 2007, Blackstone continued its historic sale of office buildings by selling 10 Class-A office buildings located in Austin to a joint venture led by Thomas Properties Group for about $1.15 billion , a price amounting to about $340/SF for the 3.4 million square foot portfolio. The portfolio was just 82% occupied at the time of sale, and the CEO of Thomas Properties Group was upbeat about the potential upside through leasing up the office buildings, as well as the potential upside from the projected population growth that Austin would be experiencing over the next five years.

From Blackstone’s perspective it was an easy decision to sell the Austin assets, even with the potential upside of the properties. Austin is a secondary market that would definitely be susceptible to a steep drop in property values in the case of a market downturn, and this portfolio certainly wasn’t part of the approximately 20-30% of properties that Blackstone would want to hold onto through the downturn.

Sale of Seattle Office Buildings to Archon

As part of Blackstone’s February 11th sale of Seattle and Washington D.C. assets to Beacon, Beacon agreed to acquire additional office buildings totaling 2.4 million SF. However, Beacon arranged for Archon to acquire these Seattle buildings for about $921 million, at a price coming out to about $400/SF.

Archon, an affiliate of Goldman Sachs with operations based in Texas, added to its relatively meager portfolio of two office buildings, creating a portfolio of 3 million SF of office buildings overnight, and becoming one of the largest owner of office buildings in Seattle.

Sale of Sacramento Office Buildings to Hines

On May 1, 2007, Blackstone sold EOP’s 2.4 million SF of Sacramento-area office buildings to Hines for about $760 million. Hines emerged as the top bidder against Shorenstein Partners and other institutional investors, in a transaction which a local real estate broker involved in the deal described as “The largest ever. There’s nothing even close.”

Hines, a multinational developer, likely appreciated the reasonable price per square foot of the investment, which was priced at less than what it would cost to reconstruct the office buildings.

Blackstone likely foresaw no significant upside from holding onto EOP’s Sacramento assets, especially in the secondary market of Sacramento, which would be susceptible to a significant drop in real estate prices in the case of a market downturn. At best, if the Sacramento office market performed well, other real estate investors would simply build additional office buildings in Sacramento which would make any significant rent increases highly unlikely.

Sale of Downtown Chicago Office Buildings to Tishman Speyer

On September 4, 2007, Blackstone finalized the sale of EOP’s 6.6 million square feet Downtown Chicago office portfolio to Tishman Speyer for $1.8 billion, or approximately $272/SF.

Map of Downtown Chicago office buildings acquired by Tishman Speyer

Sale of Suburban Chicago Office Buildings to GE Real Estate

About a week after selling EOP’s Downtown Chicago assets, Blackstone sold EOP’s suburban Chicago office buildings to GE Real Estate. This transaction was marketed by HFF, the same company that handled the sale of EOP’s Downtown Chicago office buildings to Tishman Speyer. Commenting on the sale, HFF managing director Jamie Fink referred to the sale as “one of the largest and best offerings of office properties in Chicago history, combined top-quality office space in excellent in-fill locations in CBD and suburban locations. We are pleased to have found outstanding buyers for the portfolio to maximize value for Blackstone.” (bold added) Fink’s comment points out that by separating the suburban assets for the in-fill locations, Blackstone was able to maximize the total sale proceeds from its Chicago assets. The separating and grouping of EOP’s assets is one of the main methods Blackstone had at its disposal to maximize sale proceeds across its entire portfolio.

Recap as of September 30, 2007

About six months after Blackstone’s acquisition of EOP, Blackstone had already sold off about 65 million SF of the properties acquired through it’s takeover of EOP for a total selloff amount of $30 billion (about $461/SF for the properties sold). Therefore, the price to Blackstone for the remaining 35 million SF of EOP’s portfolio was under $10 billion, which comes out to about $273/SF. Simply through selling off most of EOP’s holdings, Blackstone was able to retain EOP’s remaining holdings at a tremendous price of only $273/SF. Moreover, many of the properties that Blackstone sold before September 30, 2007, were EOP’s less exciting holdings in secondary markets, whose values would be much more negatively effected by a recession. These secondary market holdings include the office buildings in Atlanta, Portland, Sacramento, Austin, and Denver.

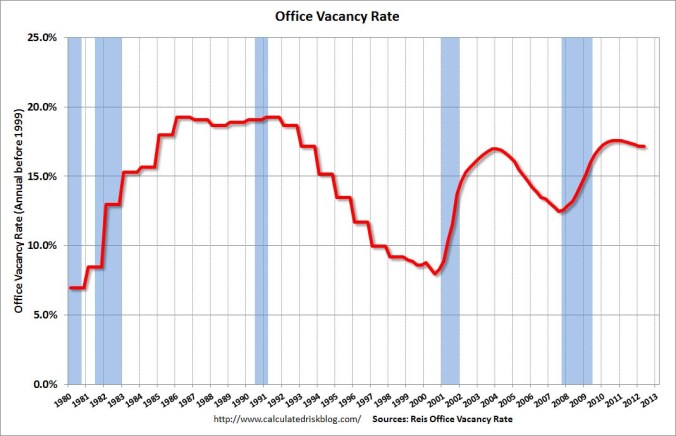

EOP’s remaining assets still included incredible assets in solid locations such as Boston, West Los Angeles, Santa Monica, New York City and Silicon Valley, which Blackstone would be comfortable holding onto through the market downturn. As the graph below titled “Office Vacancy Rate” shows, starting from almost exactly September 30, 2007, office vacancy rates began climbing from approximately 12.5% to 17.5%. Not coincidentally, as the other below graph shows, commercial property prices also dropped significantly starting from approximately September 30, 2007.

Interestingly, Blackstone’s selling of EOP assets stopped almost immediately and after September 30, 2007. It wasn’t until 2013 and 2014 when Blackstone would begin its major, selloffs of EOP’s remaining office buildings.

Graph showing the office vacancy rate between 1980 and 2013 (Recession time periods are shaded)

Graph showing change in commercial real estate prices from 2000 to 2012

Forfeiting the Petaluma Office and Santa Rosa Buildings to Lenders

During the depths of the recession, Blackstone lost 15 of EOP’s buildings to foreclosure. Ten of these buildings that were located in Petaluma were acquired during 2005 (before Blackstone’s buyout of EOP) from Basin Street Properties as part of a 44 building acquisition totaling $263 million. As part of the purchase, EOP assumed a $35 million loan at a 7.41% interest rate collateralized by these buildings. As the market entered a recession, the value of these buildings decreased significantly and Blackstone likely realized that it wasn’t worthwhile continuing to make mortgage payments on these properties and contributing additional capital, when it didn’t seem too likely that the value of these buildings would surpass their loan amounts anytime soon. By handing these buildings over to lenders, Blackstone essentially “sold” these buildings to the lender at a price equal to the loan amount.

Similarly, Blackstone owned five buildings in Santa Rosa which it acquired in 2005 from Bedford Property Investors (before Blackstone’s buyout of EOP). As part of Blackstone’s $39 billion acquisition of EOP, Blackstone assumed a $15 million loan on these buildings. During 2010, these buildings totaling 68,000 SF were operating at 64% occupancy and the property values had decreased significantly. Therefore, Blackstone allowed the buildings to foreclose, and essentially “sold” these buildings to the lender at a price equal to the loan amount.

Refinancing the $7 Billion Loan at end of 2010

Upon acquiring EOP, Blackstone financed the $39 billion acquisition with about $35 million of debt and $4 million of cash. During its selloff of EOP’s properties, Blackstone used the sale proceeds primarily to pay down the $35 billion of loans.

According to the Wall Street Journal, Blackstone had about $7 billion of remaining debt on EOP’s office buildings as of the end of 2010. The debt was set to mature in 2012, and Blackstone therefore needed to refinance this debt to extend the maturity date. At the end of 2010, Blackstone reached an agreement with its lenders in which it would pay down the debt by about 10% ($700 million), the maturity date would be extended to 2014, and the interest rate on the loans would increase by one percentage point.

Sale of Santa Rosa Office Buildings to Basin Street Properties

In 2012, Blackstone sold 17 Santa Rosa, CA office buildings to Basin Street Properties for about $100 million. Interestingly, seven years earlier Basin Street Properties sold these properties to Equity Office (before the buyout) for about $250 million and now it was reacquiring them for about half that amount.

Sale of New Orleans Office Complex to Feil Organization

On June 17, 2013, Blackstone sold EOP’s New Orleans office buildings to New York-based Feil Organization. The 1.2 million SF office complex is located midway between Downtown New Orleans and the New Orleans Airport, offering a convenient location for businesses. The property was over 90% leased at the time of sale, and Blackstone likely realized that there wasn’t any significant upside potential remaining in the property and that they would be best off selling the property at that time.

Sale of Pasadena Office Buildings to Prudential

Also in 2013, Blackstone sold its Pasadena, CA office buildings totaling approximately 500,000 SF to Prudential Real Estate Investors for about $400/SF. The buildings were stabilized (fully leased and operating at their full potential) and the sale was consummated at a 5% cap rate. Prudential commented on the acquisition by praising the investment as “consistent with our core strategy of investing in high-barrier-to-entry office markets in Southern California at less than duplication cost.”

Sale of Cambridge Office Buildings to Jamestown

On December 17, 2013, Blackstone sold two of EOP’s Cambridge, MA office buildings totaling 260,000 SF for $193 million, a price coming out to almost $750/SF. Jamestown, the Atlanta-based buyer of the office buildings, owns many properties in Boston and has decades of operating history in that market.

Sale of Wellesley, MA Office Buildings to MFC

On December 12, 2013, Blackstone sold the eight-building, 700,000 SF Wellesley Office Park to Manulife Financial Corporation for $237 million. Commenting on the sale of the office park, the listing broker explained, “Wellesley Office Park can easily be considered ‘best in class’ and embodies all the long-term criteria standards of institutional investors: irreplaceable setting, convenient access, on-site amenities and marquee tenancy.”

Sale of Boston Office Buildings to Oxford / JP Morgan

On May 18, 2014, in Blackstone’s biggest sale of EOP properties since the downturn, Blackstone sold five Boston office buildings totaling 3.2 million SF for $2.1 billion, or approximately $656/SF. This sale consisted of about half of EOP’s Boston-area office holdings at the time of sale. According to the Moody’s Commercial Property Price Index, at the time of this sale, commercial property prices during May 2014 were about 11% higher than prices during 2007.

Sale of San Mateo Office Buildings to Rockpoint Group

On September 8, 2014, Blackstone sold three office buildings in San Mateo totaling about 306,000 SF for $128.5 million. The buildings were all occupied by prominent technology companies and were described by the listing brokers as “some of the best product built on the 92 corridor.”

Sale of Bay Area Properties to Hudson Pacific Properties

On December 9, 2014, Blackstone finalized one of the most high-profile and creative dispositions of EOP’s properties, when it disposed of 26 of EOP’s Silicon Valley office buildings totaling 8.2 million SF to Hudson Pacific Properties, a Los Angeles based REIT. In return, Blackstone received $1.75 billion in cash and a 48% equity stake in Hudson Pacific Properties, a total value of $3.5 billion. Click here to access a presentation prepared by Hudson Pacific Properties to their shareholders about the EOP portfolio acquisition.

Map showing location of individual assets which were part of merger with HPP

Simple graphic showing HPP’s acquisition of EOP’s Northern California Portfolio

From Blackstone’s point of view, the sale to HPP offered it an opportunity to sell all of EOP’s Northern California properties (except the San Francisco Ferry Building which is a joint venture with numerous partners) simultaneously, while achieving a fair market price for the assets, and most importantly also partaking in the future upside of EOP’s Northern California portfolio through its significant ownership in Hudson Pacific Properties.

At the time of sale, the average occupancy of the office buildings was approximately 81%, compared to a market occupancy of over 90%. Also, the average rents were about 15% lower than market rents at the time of sale. Compounding on these strong trends, employment growth in the Bay Area is more than double the national average, there are extremely high barriers to entry in the Bay Area market, and Class A office market rents are still significantly below peak market rents during the dot-com bubble. Blackstone certainly understood these incredibly strong real estate fundamentals and made a conscious decision to retain a stake in the upside of EOP’s Northern California portfolio.

Sale of Boston Office Buildings Oxford / JP Morgan

On August 13, 2015, Blackstone sold its 91.5% ownership in two Downtown Boston office buildings for approximately $1.19 billion dollars. Considering that Blackstone’s effective SF of the building was 1,120,000 SF, the price per SF was over $1000. The trophy office buildings were sold to a joint venture of Oxford Property Group (A Canadian pension fund) and JP Morgan. Because pension funds are more focused on obtaining stable dividend-like returns rather than massive profits from acquiring deals at below-market value, Blackstone was able to sell these trophy office buildings for top dollar.

Sale of West LA Office Buildings to Douglas Emmett

In a sale initiallly reported on November 25, 2015, Blackstone sold a portfolio of four office buildings totaling 1.7 million SF in the Westwood submarket to Douglas Emmett for about $1.34 billion, or $777 per square foot. Douglas Emmett, a dominant West LA office REIT, partnered with the Qatar Investment Authority on the acquisiton and would now control about 74% of office space in the Westwood submarket.

Bird’s Eye view of 4 office building acquired by DEI and 2 buildings already owned by DEI

From Blackstone’s perspective, this looks like a well-timed sale. At the time, the office buildings were about 89% leased and coming off of over 5 years of consistently increasing market office rents, which allowed Blackstone to market the property at a higher price based on the increased market rents.

Sale of Individual Properties between 2007-2016

In Blackstone’s attempt to maximize proceeds from the sale of EOP’s office buildings, Blackstone often determined that the best course of action was to sell buildings individually. The spreadsheet below shows a list of Blackstone’s individual office sales of EOP’s holdings. The proceeds from the sales finalized before September 30, 2007 were already accounted for in the “Recap as of September 30, 2007” section above. The remaining sales are accounted for in the “Recap as of December 31, 2016” section below.

Recap as of December 31, 2016

As of the end of 2016, Blackstone’s acquisition of EOP has emerged as an extremely successful and profitable one, with Blackstone continuing to reap the rewards from its remaining 8 million SF EOP portfolio, with virtually no skin in the game.

In fact, back in December 2014, when Blackstone sold EOP’s Bay Area portfolio to Hudson Pacific Properties, Blackstone crossed the $39 billion sales threshold, meaning that the sales proceeds it had received until that date already exceeded the full amount it initially paid for EOP in February 2007.

As Blackstone continued to sell properties during 2015 and 2016, Blackstone would rack up huge windfalls as it sold EOP’s top-quality holdings including EOP’s last remaining office building in Manhattan for over $2,000/SF, multiple office buildings in Santa Monica for over $1,000/SF, and multiple office buildings in Boston for over $1,000/SF. Blackstone’s strategy of holding onto EOP’s properties in areas with strong market fundamentals (High demand, low/constrained supply) has began paying huge dividends. As of the end of 2016, Blackstone still owns about 8.5 million SF of office buildings from it’s 100 million SF acquisition of EOP, and Blackstone has already received $44 billion from EOP’s property sales.

List of Properties Still Owned by Blackstone/EOP and Unknown Status

As of January 1, 2017, Blackstone still owns approximately 8.5 million SF of office buildings which has either been confirmed as still being owned by Blackstone or where there aren’t any articles or information about a sale since February 2007.

These buildings are among EOP’s most valuable and attractive office buildings including four office properties in Santa Monica, three office buildings in Boston, and many other trophy office buildings.

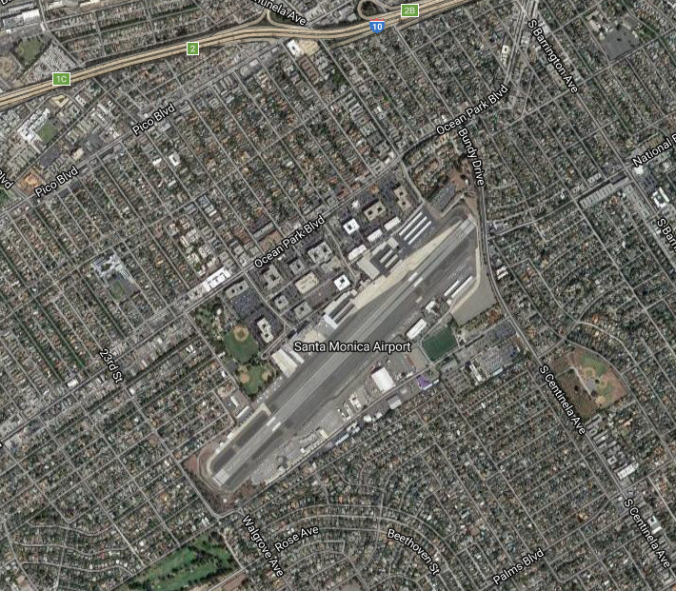

The most interesting of these remaining buildings (and also the building which originally sparked my interest in this transaction) is the approximately 1,000,000 SF Santa Monica Business Park in Santa Monica, CA. The 12-building Santa Monica Business Park is spread across dozens of acres and several full blocks abutting the Santa Monica Airport. Unlike many other office buildings which rise 50-60-floors above the street and have subterranean parking, these twelve relatively-short buildings are spread across many acres of land with abundant paved surface parking. The resulting suboptimal use of land is very attractive from a future development perspective, which may allow the property owner to develop a much larger and more valuable property sometime in the future.

Simply because of the future development opportunity or the extremely rare opportunity to acquire dozens of acres of land in Santa Monica, an investor may be willing to acquire the property for significantly more than could otherwise be justified through a simple valuation based on the property’s income. Blackstone undoubtedly recognizes the unique, rare opportunity that this property offers, which is likely one of the reasons that this property is one of the last of the EOP properties still retained by Blackstone.

Site plan of Santa Monica Business Park

Aerial view of Santa Monica Business Park

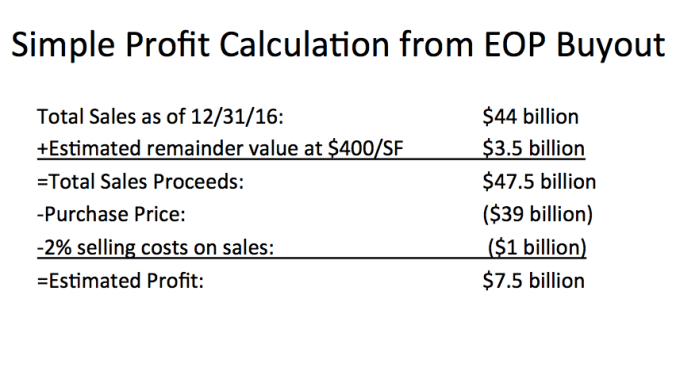

Considering the incredible quality of EOP’s remaining office holdings, a conservative estimate of the value of EOP’s remaining holdings would probably be $400/SF or a total of $3.5 billion, which is the amount we will use to calculate Blackstone’s estimated profit from its buyout of EOP.

Conclusion

Considering that EOP’s 8 million SF of remaining office buildings are estimated to be worth around $400/SF, Blackstone would profit approximately $7 billion, approximately tripling its initial $3.5 billion investment.

In this accounting and analysis, we’ve assumed that Blackstone didn’t receive any cash flow during its ownership of EOP’s properties. That’s to say that the amount of rental income Blackstone received from EOP’s properties is approximately equal to the building’s expenses, interest payments, and amounts that Blackstone invested in renovating some of EOP’s office buildings.

Below are some lessons and takeaways from Blackstone’s selloff of EOP’s assets:

Lesson 1: Market Timing is Key

Blackstone’s successful market timing has been one of the keys to its success in its buyout of EOP. With a few exceptions, Blackstone sold the overwhelming majority of the EOP’s properties before the start of 2008 and after the start of 2014. Blackstone intentionally refrained from selling many properties between 2008 and 2014, during the time period in which property values were depressed. This strategic market timing is one of the reasons Blackstone was able to achieve top dollar for all of its property sales and triple its initial equity investment.

Lesson 2: Debt can greatly amplify returns.

Blackstone’s total sales of EOP’s assets (including the projected sales of its remaining holdings) amount to $47.5 billion, or about 25% more than the $38.7 billion (including debt) it acquired EOP for. However, rather than earning a 25% total return on its initial investment, Blackstone earned a 200% return on its initial investment.

Because it completed the transaction with 90% borrowed money, Blackstone earned an over 200% return ($7 billion) on its initial $3.2 billion investment. This goes to show that just as financing can lead to disastrous results (as it did for Macklowe Properties and Maguire Properties), it can just as easily amplify an investor’s ROI (return on investment.)

Lesson 3: Always plan ahead and have multiple exit strategies.

A lesson can be learned by understanding the difference between Sam Zell’s ownership situation and Blackstone’s ownership situation. Sam Zell built EOP from the ground up and was its largest shareholder at the time of EOP’s sale to Blackstone. Zell built a company with assets totaling over $39 billion which was being valued by the public markets at only $25 billion. As the captain of a ship (EOP) that was heading toward a storm (the looming recession), Sam Zell’s only exit strategy was to sell his entire ship to one of the few investors who could actually afford a $39 billion acquisition. Due to the REIT investment vehicle, it would be nearly impossible to sell of EOP’s precious cargo individually, which would likely cause major confusion and panic by EOP’s shareholders. Therefore, Zell was forced to sell EOP to Blackstone for less than the value of its individual assets, and was incredibly lucky to be able to finalize a sale to Blackstone at such a price before the recession.

On the other hand, Blackstone had many more exit strategies. Blackstone acquired EOP using capital raised through its funds, which had been locked in for 10 years. Therefore, Blackstone had the option to either retain individual properties or to sell individual properties depending on which would maximize profits. The flexible nature of Blackstone’s funds also enabled it to pursue flexible exit strategies including selling properties individually, selling portfolios of properties, or even exchanging its properties for partial ownership of a REIT as it did when it disposed its Silicon Valley portfolio to Hudson Pacific Properties.

Lesson 4: “Buy wholesale, sell retail” to maximize profits

Blackstone initially acquired EOP’s 100 million SF portfolio at an average price of $390/SF, and within six months had sold about 2/3rd of EOP’s portfolio for about $30 billion. After six months, Blackstone retained 35 million SF of EOP’s portfolio at a remaining price of about $10 billion. By “buying wholesale and selling retail,” Blackstone was able to reduce its purchase price of the remaining 35 million SF to $273/SF, while still retaining many of EOP’s trophy properties. By December 2014, with over 8 million SF of EOP’s properties still under its ownership, Blackstone had sold enough of EOP’s portfolio to recoup the entire $39 billion it spent on EOP.

Lesson 5: Maximize sales proceeds by selling a portfolio of uniform assets rather than inconsistent assets. If buyers of a portfolio are forced to acquire properties they’re not enthusiastic about or are not uniform, they’ll just offer less

During its selloff of EOP’s properties, Blackstone grouped together assets in a way that would maximize the prices it obtained for EOP’s properties. Most notably, Blackstone sold properties separately based on the location of each property. For example, Blackstone sold all of its San Diego properties to Irvine Company, all of its Atlanta properties to Barry Real Estate Companies, all of its Orange County properties to Maguire Properties, etc. Selling these properties separately enabled Blackstone to sell these buildings to specialized, regional investors for a much higher price than a combination of national office buildings would sell for.

Further demonstrating Blackstone’s strategy of combining uniform assets, Blackstone separated its Chicago portfolio of office buildings into an urban portfolio and a suburban portfolio. The suburban portfolio was sold to GE Real Estate and the urban portfolio was sold to Tishman Speyer.

Lastly, Blackstone separated its assets based on how each building was performing. In selling its entire Manhattan portfolio to Macklowe Properties for $7 billion, the sale notably excluded EOP’s building which was located at 1095 Avenue of the Americas. At the time of Blackstone’s acquisition of EOP, 1095 Avenue of the Americas was undergoing a thorough renovation. Blackstone likely reasoned that if it were to sell the non-income producing, empty building to Macklowe Properties, Macklowe would have wanted the building to be included in the 8-building sale as a freebie. Rather than giving Macklowe any opportunity to negotiate, Blackstone retained the building which would eventually be sold for $2.2 billion.

Lesson 6: Understand market fundamentals and use them to guide your investments. Ideal market characteristics: High (and growing) Demand; Low (and shrinking) Supply with High Barriers to Entry

Another lesson that can be learned is that real estate investing is simply a supply-and-demand business. Increasing demand and constrained supply will generally lead to higher rents and higher property values. On the other hand, decreasing demand and increasing supply will lead to lower rents and lower property values.

Both Blackstone and EOP (before the buyout) concentrated their efforts on acquiring properties in high demand, constrained supply areas such as Boston, Manhattan, West Los Angeles, Santa Monica, and San Francisco, where they knew rents and property values would appreciate much more quickly than suburban areas. This strategy would eventually pay dividends as rents (and therefore property values) in Santa Monica, Boston, and Silicon Valley would rebound far above 2007 levels.

Lesson 7: A property can be worth a different amounts to different investors/owners

It’s common for institutional investors, pension funds and sovereign wealth funds to be willing to pay much higher prices for properties than opportunistic investors. This is because of the different investment goals that each buyer has. For example, institutional investors are satisfied with acquiring properties at market value, because they would still achieve their goal of earning a stable 4-5%. On the other hand, most private investors intend to improve properties, raise income, and eventually sell the property for a much higher price. Therefore, it’s important to keep in mind who the other party is, what their intentions are, and what type of return are they hoping to earn.

On a more practical level, if you’re selling a smaller property, it may be a good idea to seek out buyers who are chasing modest returns (for example retirees, and out-of-country investors) whose investment choices are prioritized by safety and stability rather than large profits.

Lesson 9: Don’t be rushed into making deals or decisions

As reported by the Observer, Macklowe’s acquisition of EOP’s Manhattan portfolio could be best described as rushed, anxiety-filled, sloppy, down-to-the-wire, and ego-driven. Harry Macklowe, a dealmaker that was primarily focused on the big picture, couldn’t resist the opportunity to instantly become one of the largest landlords in Manhattan.

With over 50 years of experience under his belt, he made the huge mistake of betting his entire life’s work on acquiring an eight-building portfolio at a 99% loan-t0-value. Furthermore, the loan was due in just one year, Macklowe would not have sufficient time to complete due diligence, and the properties were priced at an unreasonable 3.6% cap rate.

Macklowe’s poor decision making can be primarily attributed to impatience and lack of sufficient time to review all necessary information and to make a logical decision. According to the article, Macklowe and his attorneys didn’t even have enough time to review the final contract before being pressured into wiring the purchase funds into escrow.

Lesson 10: Don’t let success get to your head

In the years leading up to Macklowe’s acquisition of EOP’s Manhattan Portfolio, Macklowe experienced a major success which may have played a part in Macklowe’s reckless acquisition of EOP’s Manhattan portfolio.

In 2003, Macklowe acquired the General Motors building in Manhattan for $1.4 billion. Within a few years, the building’s value was estimated at $2.8 billion. After experiencing a billion dollar profit, Macklowe probably became arrogant and was therefore able to justify acquiring a $7 billion dollar portfolio with just a $50 million down payment. “After all, property values in Manhattan are always going up and I have the magic touch.”

Lesson 11: Too much debt is dangerous (Macklowe and Maguire).

Two of the most unfortunate buyers of EOP’s portfolio were Maguire Property Group and Macklowe Properties, both of which acquired properties with extremely high levels of debt. Macklowe acquired EOP’s Manhattan Portfolio with over 99% of debt, and Maguire Property Group’s acquisition of EOP’s Orange Country Properties made it the highest leveraged office REIT in the country.

To understand how debt can increase an investment’s risk, let’s assume that two investors acquire the same $1 million property, one in an all-cash purchase and the other with a $750,000 loan (75% LTV).

If the property declines in value by 25%, the leveraged investor’s equity in the property is completely washed out, meaning that the investor will lose its entire $250,o00 down payment because the property’s value is now equal to the loan amount.

However, the investor who acquired the property all-cash, will still have $750,000 equity . Instead of losing its entire investment, the all-cash investor will only lose 25% of its initial $1 million investment.

Although Blackstone acquired EOP with over 90% leverage, it already had buyers lined up for a substantial number of EOP’s buildings so in it’s mind it would be a 50% LTV in a few months, rather than the 90% LTV at the time of closing.

outstanding post. very thorough and enjoyable to read. how did you find data to reconstruct the sale of various portfolios and their stats (sales price, square feet, etc)?

LikeLike

Pingback: 10 Years After the Recession, US Office Sales Have Regained Traction - CommercialCafe