Invitation Homes Logo

Deal Summary

In 2012, with home prices remaining near bottomed-out levels following the Great Recession, Blackstone founded Invitation Homes, with the intention of acquiring tens of thousands of single family homes throughout the United States. In founding Invitation Homes, Blackstone created a vertically-integrated, scalable company with in-house capabilities of acquiring, renovating, leasing, maintaining, and managing single family homes. Blackstone hoped that its plan of creating the largest vertically-integrated single family home rental company would enable it to achieve the economies of scale that would be necessary in order for the company to appeal to an income-oriented end buyer.

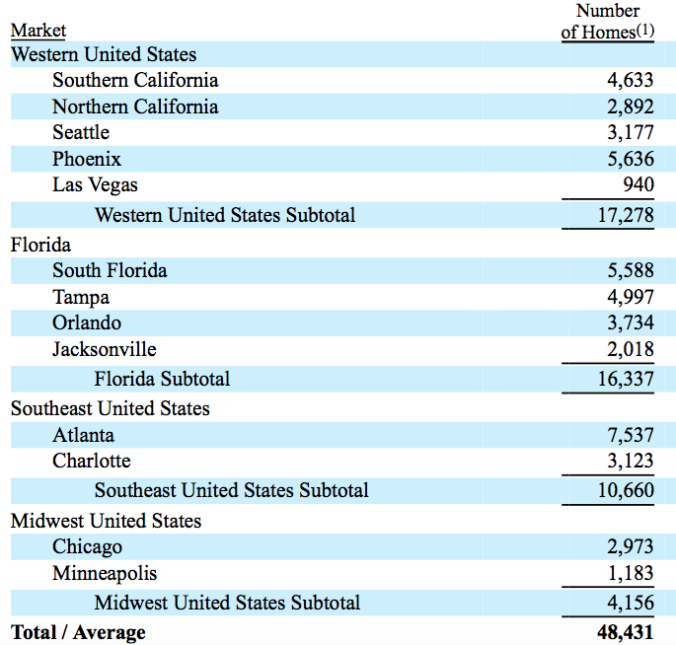

Between 2012 and 2016, Blackstone acquired almost 50,000 single family homes in thirteen markets including Southern California, Northern California, Seattle, Phoenix, Las Vegas, South Florida, Tampa, Orlando, Jacksonville, Atlanta, Charlotte, Chicago, and Minneapolis for purchase prices totaling $8.3 billion (about $166,000 per home acquisition). Immediately after acquiring each of the nearly 50,000 homes, Blackstone invested an average of approximately $25,000 into renovating each of the homes, thereby investing an additional $1.2 billion into its portfolio of Single Family Homes. Therefore, Blackstone’s total initial costs (including purchase prices and renovation costs) for its single family home portfolio totaled approximately $9.6 billion.

By late 2016, Invitation Homes had borrowed over $7.6 billion through both mortgage loans and credit facilities, leaving Blackstone with just a $2 billion equity investment remaining in Invitation Homes. On February 1, 2017, Invitation Homes conducted an initial public offering (IPO) on the New York Stock Exchange, through which Invitation Homes raised approximately $1.54 billion through the sale of approximately 25.49% of the company’s equity. Considering that as of the date of the IPO Blackstone’s net investment in Invitation Homes stands at $2 billion, and Blackstone’s remaining 75.49% share of Invitation Homes is valued at approximately $4.33 billion, Blackstone has earned a profit of approximately $2.3 billion through its venture into the single family home rental business.

Let’s take a deeper look into Blackstone’s venture into the single-family-home rental business:

Background

In 2012, Blackstone raised its largest real estate fund to date, raising over $13 billion from its investors. Considering that real estate is usually acquired with debt, this $13 billion equipped Blackstone with over $50 billion of buying power, assuming a 75% Loan-to-Value ratio. The fund, Blackstone Real Estate Partners VII, planned to acquire opportunistic real estate investments where Blackstone could implement active management strategies in order to earn outsized returns for investors.

Because of Blackstone’s $50 billion of purchasing power, it didn’t make much sense for Blackstone to seek out individual investment opportunities spread across different property types and regions. Instead, Blackstone needed to seek out significant market opportunities where it could deploy billions of dollars of capital in order to profit off of those significant market opportunities.

For example, in 2010 Blackstone formed Indcor Properties and embarked on a nationwide buying spree of industrial properties, thereby betting on a strong resurgence of warehouse space because of the generally improving real estate market and increasing prevalence of E-Commerce. Over the next four years, Blackstone assembled a portfolio of warehouse buildings totaling 117 million SF across 29 markets. In December of 2014, Blackstone sold Indcor properties for $8.1 billion to GIC, Singapore’s Sovereign Wealth Fund. This business model of placing big bets on perceived market inefficiencies has been repeated by Blackstone throughout the world, with property types including motels, warehouses, retail, and office buildings.

In 2012, the real estate market was still rebounding from the Great Recession. Following the subprime mortgage crisis, the homeownership rate declined significantly, which was likely attributable to a variety of reasons, including prospective homeowners’ financial limitations during the Great Recession, an increasing number of households that now preferred renting rather than owning, and shifting demographic trends.

Line graph showing the increasing % of renters and the decreasing % of homeowners between 2006 and 2014

Single Family Homes vs. Multi-Family Apartment Buildings

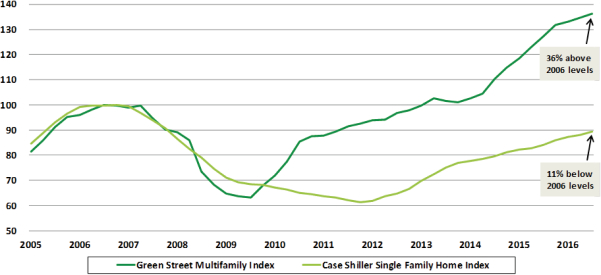

Based on the below price indexes, nationwide home prices and multifamily prices both plummeted more than 30% between 2007 and 2009. While this might not initially seem like a huge decline, it’s important to keep in mind that these indexes represent nationwide averages. Homes located in markets which had experienced high levels of new construction and population growth during the early 2000s (such as Phoenix, Las Vegas, Florida, and California’s Inland Empire) experienced up to 80% declines in home prices. On the other hand, home prices in more stable markets (such as Iowa) were relatively unaffected by the Great Recession.

By 2012, national multifamily prices had almost completely recovered to their pre-recession price levels, but national home prices were still 40% below 2007 price levels. Despite the tailwinds of historically-low interest rates, stimulating government programs, and an improving economy, home prices remained stubbornly low as the aforementioned factors (financial limitations, preference toward renting, and demographic trends) together with the ongoing foreclosures continued to apply downward pressure to home prices.

Comparison between a Multifamily Price Index and Single Family Home Index (Note the relatively lagging single family home prices as of 2012)

In early 2012, in an interview with CNBC, Warren Buffet lauded investments in single family homes, referring to them as “as attractive an investment you can make.” In the interview, Warren Buffet went as far as mentioning that if he could find a way to effectively manage 200,000 single family homes, he would acquire that many homes. At a price of $200,000 per home, such an investment in 200,000 single family homes would amount to a $40 billion bet on single family homes.

Although the hassle of managing tens of thousands of homes would be a large enough deterrent to Berkshire Hathaway, Blackstone decided that the hassle would be worthwhile.

The Buying Spree

Determining which Markets to Acquire In

According to Invitation Homes’ IPO prospectus, the company was extremely intentional and calculated in determining which markets to acquire homes in. Shedding some light on the amount of research that went into Blackstone’s market research, the IPO prospectus mentions that Blackstone considered many factors including:

- Population growth forecasts

- Employment growth forecasts

- Household formation

- Historical and forecast levels of residential home construction

- Discounts to replacement cost for single-family residential housing

- Size of the Market

- Volume of new and existing home sales

- Potential yields implied by the ratio of market rental rates to single family home prices

- Forecast home price appreciation

- Forecast rental rate growth

After considering the above factors, Blackstone decided on acquiring the bulk of its single family homes in the Western United States and Florida. Over 1/3rd of Invitation Homes’ revenues are derived from Florida alone, and another 1/3rd of Invitation Homes’ revenues are derived from California, Arizona, and Washington. Noticeably excluded regions from Invitation Homes’ portfolio include most of the Midwest (except Chicago), Texas, and the Northeast. While we don’t know the exact reasons of why certain markets were excluded, we do know that excluding said markets was a very calculated decision backed by rational reasoning.

The Underwriting Process

Invitation Homes acquired 94% of their nearly 50,000 homes in single-asset acquisitions, which points to a tremendous amount of time and work by Blackstone’s in-house acquisition team. Specifically, Invitation Homes’ IPO prospectus states that its acquisition team analyzed over 1,000,000 individual homes since 2012. The “disciplined and proprietary” underwriting methodology includes the analysis of 64 factors including the following:

- Neighborhood desirability

- Proximity to employment centers, schools, transportation corridors, community amenities

- Construction type

- Extent of ongoing capital needs

Acquisition Channels

In seeking acquisition opportunities, Invitation Homes’ local acquisition teams sourced leads by building relationships with brokers, banks, contractors, homebuilders, and smaller single family home rental companies. Because of its multiple acquisition channels, Invitation Homes was able to adapt to changing market conditions by shifting its focus between its numerous acquisition channels.

For example, as the state of the single family home market changed between 2012 and 2016, Invitation Homes gradually shifted from acquiring most of its properties through distressed transactions (bank-owned, short sales, auction) in 2012, to eventually acquiring over 2/3rd non-distressed sales during the twelve months leading up to November 2016. Invitation Homes’ many acquisition channels enabled the company to adapt to the shift in the market and continue building up its portfolio.

Invitation Homes’ Average Home

The average single family home acquired by Invitation Homes was an approximately 1,850 SF 3 Bedroom/2 Bath home which would eventually be rented for approximately $1,623/month. This strategic criteria was meant to appeal to a large pool of less transitory renters.

The 3 bedroom / 2 bath home is one of the most flexible bedroom/bathroom configurations, thereby appealing to the largest pool of prospective home renters. For example, a 3 bedroom/2 bath home could work for any of the following sample renters:

- A 4-person family

- Retired baby boomers

- A young couple that may be looking ahead to start a family in the near-future

Additionally, the $1,623 average rental amount also appeals to a large pool of renters, who would likely be able to afford the rent payments even if the economy softens or in times of temporary hardship.

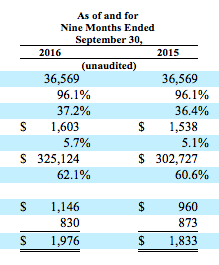

Therefore, the flexible homes and affordable prices both allow Invitation Homes to attract and maintain less-transitory renters, thereby greatly reducing the company’s maintenance expenses and vacancy loss, both of which are usually incurred upon tenants moving out. More specifically, in the IPO prospectus Invitation Homes alludes to the company’s turnover rate of only 37.2%, compared to the average multifamily REIT turnover rate of 55.2%. This significant difference in turnover rates translates to a savings of tens of millions of dollars for Invitation Homes, which would otherwise be lost to vacancy, leasing costs (commissions), and maintenance.

The Ownership Process

Introduction

Just as important as acquiring the homes, is the process of efficiently managing the homes. Investment returns of single family homes are generally much lower than investment returns on multifamily properties, which meant that Blackstone had to make up a lot of ground if Invitation Homes’ returns were to be competetive with multifamily REIT returns in the public markets.

One reason for the generally lower returns of single family homes is the higher price-to-rent ratio of the single family homes relative to multifamily properties. For example, a single family home in Orlando may be worth $240,000 and have an annual market rent of $12,000/year. The price-to-rent ratio of that single family home is 20 (calculation: $240,000/$12,000). On the other hand, a 20-unit multifamily building in Orlando may be worth $1,800,000 have average rents of $750/month/unit ($180,000/year total), leading to a price-to-rent ratio of 10. In other words, every dollar invested in the multifamily property is generating twice the gross rental income of every dollar invested in the single family home. For this reason, cash flows of multifamily properties are usually much higher than cash flows of single family homes.

Secondly, investors in multifamily properties reap more benefits from economies of scale than investors in single family homes. Owners of multifamily properties usually incur significantly less expenses per unit with regards to property insurance, property taxes, maintenance and repairs, property management, etc.

Because compared to multifamily REITS Blackstone faced the above two disadvantages (generally higher price-to-rent ratios and higher expenses per unit), Blackstone knew it had to compensate for the above setbacks through other efficiencies or benefits.

Creating a Vertically Integrated Home Rental Company

One way which Blackstone hoped to achieve cost savings was by creating a vertically-integrated company, with in house capabilities of acquiring, renovating, leasing, maintaining, property management, and asset management.

- Acquisition: Invitation Homes’ in-house acquisition team has underwritten over 1,000,000 individual homes, and has acquired over 45,000 homes in single-asset acquisitions. The rigorous acquisition progress has been systemized and the company has saved millions of dollars through direct acquisitions as opposed to working with brokers, consultants, or other professionals on every acquisition.

- Renovations: After each acquisition, Invitation Homes’ renovation team spends an average of $25,000 per home prior to the homes entering the rental market. The company has likely saved millions of dollars (in time savings and cost savings) by handling the renovations in-house rather than hiring outside contractors.

- Leasing: Invitation Homes has developed an in-house leasing department where it solicits potential renters (via its leasing website and property signs), shows homes to tenants, reviews rental applications, prepares lease agreements, conducts tenant inspections, etc.

- Property Management (including maintenance): Invitation Homes’ in-house property management and maintenance team allow it to provide high levels of service to its tenants. During 2015, over 50% of tenant maintenance requests were resolved by in-house technicians, which has resulted in significant cost savings for the company, in addition to enabling Invitation Homes to provide its tenants with high levels of responsiveness and service.

- Asset management and Sales: Invitation Homes has assembled a 25-person asset management team, all but three of which people are located in local markets. The asset management team also handles decisions regarding the strategic dispositions of Invitation Homes’ individual homes.

It’s safe to say that without Invitation Homes’ vertical integration it wouldn’t have been able to reach its current levels of profitability. Invitation Homes’ vertically integrated structure has provided it with a scalable model through which it can outperform other single family operators and by which it can hope to achieve investment returns comparable to those earned by multifamily REITs.

Invitation Homes leasing sign

How to Finance 50,o00 Homes

Because of Blackstone’s implied goal of earning at least 20% annual compounded returns for its investors (a measure that has been met in its last few real estate funds), Blackstone usually prefers to leverage its investments with as much debt as possible. By investing less equity in investment opportunities, Blackstone can strive to maximize its return on equity and deploy its limited equity across many more investment opportunities. Therefore, it was of utmost importance to Blackstone to implement a favorable financing structure for Invitation Homes.

Because of the all-cash nature of distressed home acquisitions, Invitation Homes initially acquired homes using cash, or credit facilities for up to 75% of a home’s total cost (including initial cost plus renovation cost). As of September 30, 2016, Invitation Homes had six credit facilities, totaling approximately $2.4 billion at an average interest rate of approximately 3.25%.

In November 2013, Invitation Homes pioneered a new form of securitized financing for residential rental homes. Blackstone figured that just as commercial income-producing properties are grouped together and packaged into CMBS (commercial mortgage-backed securities), so too residential income-producing properties could be grouped together and packaged into a new form of RMBS (residential mortgage-backed securities) which are not just securitized by the credit of individual owner-occupant homeowners, but rather are securitized by income-producing rental properties. As of September 30, 2016, Invitation Homes’ has about $5.3 billion of outstanding securitized debt at an average interest rate of 2.5%.

By pioneering this new method of financing and reducing its borrowing costs by 3/4 of a percent (from the 3.25% interest rate credit facilities to the 2.5% interest rate RMBS debt) on the $5.3 billion of securitized debt, Invitation Homes has reduced its borrowing costs by $40 million annually.

Moreover, Invitation Homes furthered its ambitious financing agenda by reaching an agreement with Fannie Mae and Wells Fargo to secure a government guarantee for $1 billion of Invitation Homes’ securitized debt. This guarantee provides two major benefits to Blackstone: (1)Providing the Government’s seal-of-approval on the single family home rental business model and (2) Further reducing Invitation Homes’ borrowing costs because of the lower interest rate on government-guaranteed debt.

Preparing for an IPO

As of September 30, 2016, Invitation Homes has disposed of 2,491 homes which didn’t fit the company’s investment objectives. The disposed homes likely didn’t fit into Invitation Homes’ portfolio either due to the properties’ location or home characteristics (age, size, number of bedrooms, condition, etc.)

In addition to pruning its portfolio, Invitation Homes also optimized the performance of the company’s portfolio in order to maximize the company’s cash flow and net operating income. Such optimizations included increasing/maximizing property rents, reducing turnover times (time it takes to renovate and re-lease vacated homes), reducing the company’s staff, reducing financing expenses, achieving other cost savings, and maximizing other forms of income.

Blackstone knew that the presentation of Invitation Homes’ balance sheet and financial measures would be of utmost importance. After all, analysts and investors would be underwriting Invitation Homes’ stock based on the financials and metrics presented in the IPO prospectus. The below comparison chart shows that Invitation Homes was able to increase the NOI of its Same Store Portfolio (consistent set of previously-owned homes) from $302 million to $323 million from 2015 to 2016, for the first nine months of each year.

NOI/Performance

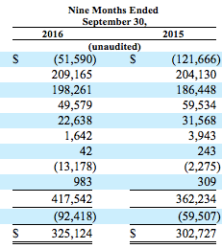

Now, let’s determine the Capitalization Rate at which the Invitation Homes portfolio was valued by the IPO. The summary chart below calculates the net loss for the first nine months of 2016 as -$51,590 for the entire Invitation Homes portfolio. However, this “net loss” includes many line items which shouldn’t be considered when calculating NOI. Such line items include “interest expense,” “depreciation and amortization,” “general and administrative” expenses, and more.

Therefore, in order to arrive at the NOI calculation, we start with the “net loss” amount above, -$51,590, and make the necessary adjustments in order to arrive at the NOI. Based on the below calculations, the NOI for Invitation Homes’ total portfolio for the first nine months of 2016 was $417,542,000. Since this amount is only for nine months out of the year, we can multiply it by 12/9 in order to arrive at an approximate full year 2016 NOI of $556,723,000.

Based on Invitation Homes’ valuation of $12.02 billion (including debt) and based on the net operating income of approximately $566,723,000 net operating income, the IPO is being offered at a 4.7% cap rate.

IPO

Through Invitation Homes’ initial public offering, Blackstone solicited the public markets to infuse $1.54 billion of equity onto Invitation Homes’ balance sheet. The infusion of equity was used to pay down Invitation Homes’ debt from $7.69 billion to $5.98 billion. Although Blackstone’s ownership of Invitation Homes was reduced from 100% to 74.51%, the value of Blackstone’s equity remained constant at $4.33 billion (as shown below), because the money raised through the IPO was used to pay down Invitation Homes’ debt, thereby increasing the company’s total equity value. After the IPO, Blackstone’s 74.51% ownership share of Invitation Homes was worth the exact same amount as its 100% ownership share was worth before the IPO.

What did Blackstone accomplish through its IPO of Invitation Homes?

By offering a 25.49% stake of Invitation Homes on the public markets, Blackstone created an exit strategy for its investment in Equity Homes. Blackstone now has a market through which it can sell all or part of its equity in Investment Homes at fair market value. This is important, considering that Blackstone will eventually need to return capital to the investors of its real estate fund, Blackstone Real Estate Partners VIII.

Additionally, by raising $1.54 billion of capital from the public markets, Blackstone was able to reduce Invitation Homes’ debt from a 65% loan-to-value to a 50% loan-to-value. This loan pay down significantly reduces Invitation Homes’ vulnerability/risk to a downturn in the residential home market or a sharp rise in interest rates.

Now that we’ve gone through an explanation of the deal, let’s go through some lessons and takeaways:

Lessons and Takeaways

Lesson 1: There are advantages of not being exclusively committed to certain property types.

The first lesson from Blackstone’s formation of Invitation Homes is the benefit of not exclusively investing/specializing in one property type. Many real estate investors choose to specialize in specific property types such as multi-family, office or industrial.

The problems of specializing in specific property types is that from time to time certain property types may be undervalued, whereas other property types may be overvalued. Since Blackstone invests in many different property types (including retail, office, industrial, multi-family, etc), Blackstone can change its strategy by focusing on specific property types it believes to be undervalued. For example, in 2010 Blackstone had billions of dollars to invest, and specifically chose to invest in industrial properties which it perceived to be undervalued. Over the next few years, Blackstone acquired over 117 million square feet of industrial properties throughout the country. During the few years after 2010, industrial property prices increased and Blackstone earned substantial profits from its investment.

A couple years later, in 2012 Blackstone formed Invitation Homes and acquired about $10 billion of homes during the next years few years. Interestingly, during the two years between 2010 and 2012 (the years when Blackstone was acquiring industrial properties), single family homes prices declined. If Blackstone specialized in single family home investing (as many other investors do), then Blackstone would likely have started acquiring single family homes in 2010 because of the then low prices. But because Blackstone was also active in industrial property investing, in 2010 Blackstone realized a greater short-term investing opportunity in the industrial sector and therefore decided to invest in industrial properties.

Case-Shiller Home Price Index showing declining home prices between 2010 and 2012

Likewise, smaller investors who are comfortable with investing in different property types are better equipped to shift their strategies in case certain property types seem overvalued, undervalued, or seem to be facing supply/demand challenges.

Lesson 2: Real estate is governed by the economic principle of supply and demand

Underneath it all, real estate is a very simple business governed by the economic laws of supply and demand. Rental rates and property values are both greatly affected by the supply and demand in a market.

Throughout Invitation Homes’ prospectus, the company repeatedly alludes to the attractive opportunity of investing in single family homes by citing favorable supply/demand factors including the following:

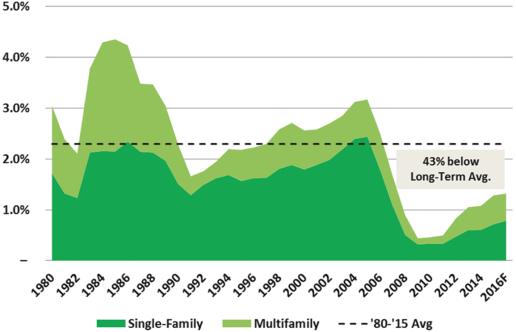

- Favorable Supply Factors (Leading to Low Supply) include:

- Below long-term average levels of new home construction. From 2007 to 2015, new housing permits as a share of households has been 43% below the 1980-2015 average levels.

- Favorable Demand Factors (Leading to High Demand) include:

- Lower homeownership rate, therefore greater number of households that are renting (Homeownership rate decreased from 69.2% in 2004 to 63.5% in 2016.

- Jobless rate has been steadily decreasing since the recession, and new household formation is accelerating

- Rising interest rates will make homeownership more expensive, thereby increasing rental demand and rental rates.

- Invitation Homes chose specifically to invest in locations exhibiting high levels of population growth.

Graph showing that housing permit levels between 2007 and 2015 are 43% below the long-term average

What makes these supply and demand factors significant? These factors interact to apply upward pressure to single family home rents and property values. In part due to these favorable fundamentals, home prices and home rents in Invitation Homes’ portfolio have increased by 6.3% and 6.2%, respectively, during the year preceding the IPO.

Lesson 3: Buy Low, Sell High

One of the best known real estate investing adages is “buy low, sell high.” Real estate is a cyclical industry, which can be especially risky and rewarding due to the significant debt which most investors use to acquire real estate. Blackstone’s venture into single family homes perfectly reflected the “buy low, sell high” adage as the Case-Shiller Home Price Index has increased from 134.01 to 185 from 2012 until the Invitation Homes’ IPO in 2016.

Lesson 4: Buy below replacement cost

The following is a quote from Invitation Homes’ IPO prospectus:

We believe that the value of our portfolio represents a significant discount to the replacement cost of a comparable portfolio today. JBREC estimates that the total New Home Replacement Cost of Invitation Homes’ portfolio of 48,431 homes is approximately $15.4 billion, or $318,500 per home, as of December 30, 2016. We believe we will continue to experience below-average levels of new housing supply in our markets which will support future rental rate growth and home price appreciation.

In the above quote, Invitation Homes explains that the cost to replace its current portfolio of 48,341 homes would cost $15.4 billion, or $318,500 per home. Based on the IPO price of $20 per share, the total value of Invitation Homes (including debt) is approximately $12 billion, or $248,236 per home. Therefore, investors in Invitation Homes’ IPO are essentially acquiring the company’s homes for 22% below the homes’ replacement cost.

Moreover, the gross book value of Invitation Homes’ 48,341 homes is $9.7 billion, or $204,000 per home. Therefore, based on the costs at which the homes were acquired, Invitation Homes acquired the homes for about 36% below the homes’ replacement cost.

The significance of acquiring homes for below replacement cost is that existing homeowners are shielded from new supply entering the market, because it would be unprofitable for builders to build new homes, if existing homes are selling for less than what it costs to build those homes.

For example, if Invitation Homes acquired a 2007-built single family home in Atlanta for $150,000, and that home has a replacement cost of $250,000, then the company can reasonably depend on two things:

- No builders will construct new single family homes until home prices surpass $250,000 (otherwise the builder’s cost would exceed market value), thereby limiting supply/competition in the market

- If the home is located in a desirable area (growing population, well-paying jobs, positive household formation, demand drivers present), then there will be upward pressure on home prices until existing home prices surpass replacement cost, so that home builders will be incentivized to build new homes and satisfy demand

Therefore, acquiring quality properties in quality markets for below replacement cost can be a great strategy as long as the property’s income and valuation also supports the purchase price based on other valuation metrics.

Lesson 5: Acquiring distressed properties is one way to acquire at below-market prices

On average, Invitation Homes likely acquired over 50% of its homes through distressed property sales. Distressed property sales include REOs, short sales, government auctions, etc. Distressed property sales are typically all-cash transactions, with short timelines, and with homes that are often in poor condition. However, distressed sales often provide buyers with opportunities to acquire properties at below market value, which usually makes up for all the aforementioned setbacks.

The below Wall Street Journal video clip provides a look into acquiring homes via distressed sales:

During its first couple of years, Invitation Homes acquired the majority of its homes through distressed property sales. However, as years passed and the real estate market improved, an increasingly larger share of Invitation Homes’ acquisitions have been through standard sales (as opposed to distressed sales). Eventually, during 2016 just 37% of Invitation Homes’ acquisitions were via distressed sales.

The opportunity of acquiring properties via distressed sales isn’t always available, but if it’s available, investors could embrace the opportunity and acquire properties at significant discounts.

Lesson 6: Acquire properties with immediate/instant built-in profits

The next lesson we can learn from Invitation Homes is the importance of acquiring properties with built-in/instant profits. Invitation Homes was able to profit on its acquisitions in two primary ways. First, by acquiring properties via all-cash distressed sales, often at below-market prices. Second, immediately after acquiring each of its 48,341 homes, Invitation Homes invested an average of $25,000 on renovating each of the homes before renting the homes out. Although the renovations costed the company $25,000, the renovations likely added at least $50,000 to the market value of each of the homes.

To understand how these profits can affect the company’s bottom line, let’s consider that a 1,800 square foot home might be worth $200,000 in excellent condition. Many homebuyers or investors would opt to simply acquire this newly-renovated home for $200,000.

However, Blackstone embarked on a different path for many of its acquisitions. Based on Invitation Homes’ business model, Blackstone would acquire the same home for approximately $140,000 in a distressed sale (through a short sale, REO, auction, etc.). Afterwards, Invitation Homes’ renovation team would spend approximately $25,000 renovating the home. Following the renovation, Blackstone’s $165,000 investment would now be worth $200,000, thereby yielding a $35,000 built-in profit for Blackstone. By enduring the additional hassle of acquiring distressed sales and renovating the homes, Blackstone earned a profit of $35,000 in this example. Considering that Blackstone acquired over 50,000 for Invitation Homes, this strategy could have earned Blackstone over $875 million if Blackstone executed this strategy on approximately 50% of its acquisitions (about 25,000 homes), earning itself $35,000 on each home.

Likewise, smaller investors can also consider acquiring distressed properties and renovating the properties in order earn immediate profits on their investments. Although there are some additional risks/challenges, the profits can be well worth the hassle.

Lesson 7: By investing upfront in capital expenditures, Invitation Homes increased the property’s cash flow and NOI, thereby increasing the Company’s value by more than the cost of the capital expenditures

As previously discussed, Blackstone spent an average of $25,000 on renovating each of the homes it acquired (about $1.2 billion total). Why would Blackstone invest $1.2 billion (well over 10% of what it paid to acquire the homes) into renovations? This was a strategic decision and one that made sense for several reasons. Obviously, one reason is increasing the homes’ appeal and the satisfaction of its tenants.

Another reason is that by investing upfront to replace the major components of the homes (roof, HVAC, water heater, long-lasting flooring) through capital expenditures, Blackstone reduced the homes’ future operating expenses. This is significant because capital expenditures are not factored into a homes income calculations, whereas operating expenses are factored into a company’s net income calculations. By initially investing $25,000 into replacing the homes’ major maintenance items, Blackstone may have saved an average of $300/month, or $3,600/year, in operating expenses due to having maintenance-free systems (HVAC, water heater, etc), not having to deal with expenses of leaking roofs, as well as the cost savings associated with the other repairs made the homes.

Considering that Invitation Homes’ IPO valued the company’s 48,341 homes at a 4.7% cap rate, a $3,600 reduction in operating expenses would lead to an increase in value of over $75,000 based on an income valuation approach (3600/.047), yielding a 200% return on the $25,000 invested in the renovations.

The implications of this lesson can be extremely profitable. Investors and property owners who may not be able to justify property renovations solely based on the projected increase in rental income, should also consider the reduction in a property’s expenses resulting from the renovation. As the saying goes, “a dollar saved is a dollar earned.” And that certainly holds true for calculating a property’s net operating income, which is often times used in calculating a property’s value.

Lesson 8: Less transitory renters/tenants -> Less turnover -> Less Vacancy and Expenses -> Higher NOI

In competing against the generally higher yields of multi-family properties, Blackstone needed to uncover indirect ways by which it could both reduce operating expenses and increase rental income relative to multi-family properties.

One such strategy implemented by Invitation Homes was maintaining a low turnover rate on its rental homes. Invitation Homes figured that the tenant base of homes is generally much less transitory than the tenants of multifamily buildings. According to Invitation Homes’ IPO prospectus, Invitation Homes’ turnover rate of its same-store portfolio is about 37.2% compared to the 55.2% average turnover rate of Multi-family REITs.

To put this into perspective, consider that out of the 48,341 homes in the Invitation Homes portfolio, about 17,982 homes are vacated in a given year (48,341 * 37.2%). Now let’s a consider a multi-family REIT with 48,341 apartment units. Based on a 55.2% turnover rate, about 26,684 apartment units would be vacated in a given year. This means that every single year the owner of the multi-family REIT experiences turnover costs for 8,702 more units than Invitation Homes does, even though each own 48,341 rental units.

How does this affect the companies’ bottom line?

Let’s take a look at what it costs to turn over a home after a tenant vacates:

- 1.5 months of vacancy ($1,600/month foregone rent): $2,400

- Cosmetic repairs (carpet, paint, etc.): $2,000

- Leasing Commission (One month’s rent; payable in 50% of leases): $800

- Total turnover costs: $5,200

Therefore, considering the additional 8,702 vacated homes and total turnover cost of $5,200, Invitation Homes saved over $45 million in operating expenses due to its relatively lower turnover rate.

Smaller-scale real estate investors can also benefit from understanding the effect of turnover rate on an investor’s cash flow. For example, a McDonalds restaurant building which is leased out for 20 years will experience no turnover for the next 20 years. However, a 20-unit retail center with 20 individual tenants will likely experience a significant amount of turnover during the same 20 year period. Although both properties may have similar net operating incomes, the yearly cash flows of the 20-unit strip center will likely be lower due to the costs associated with the higher turnover rate.

Lesson 9: The Benefits of Vertical Integration

In creating Invitation Homes,’ Blackstone was fully committed to creating a fully vertically -integrated company with in-house capabilities of acquiring, renovating, leasing, maintaining, and managing properties.

The benefits of vertically-integrated companies are as follows:

- Automated/existing platform for additional home acquisitions/selloffs/renovations/property management

- Cost Savings (Eliminate a middleman service provider)

- Quality Control (Higher customer service to tenants, Higher levels of responsiveness to vendors, More accountability to Invitation Homes’ upper-level management)

The above benefits are just a few of the benefits of vertically integrated companies. These benefits are achievable by both institutional investors and smaller-scale investors alike and should be taken into account when investors decide whether to outsource or maintain responsibility for parts of their business.

Lesson 10: Positive Leverage leads to Increased Returns

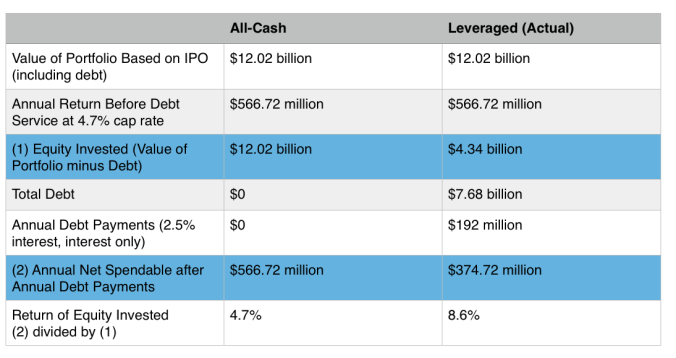

The last lesson which can be learned from Invitation Homes is of the return-amplifying effects of positive leverage. By borrowing funds for less than the company’s capitalization rate, Invitation Homes’ return on equity was greatly amplified.

In the case of Invitation Homes, the capitalization rate was 4.7% based on the company’s total value of $12.02 billion (including debt) and $566.72 million annual net income operating income. However, Invitation Homes had $7.68 billion of debt with an average interest rate of approximately 2.50%. Therefore, because of the spread between Invitation Homes’ capitalization rate and Invitation Homes’ borrowing costs, Invitation Homes’ return on equity (ROE) was amplified from 4.7% (in an all-cash ownership situation) to 8.6% (with its current leverage). The chart below illustrates Invitation Homes’ positive leverage (aka favorable leverage).

Chart showing the effects of positive leverage on Invitation Homes’ ROE

The concept of positive leverage is especially applicable in today’s low-interest-rate environment. Like Invitation Homes, smaller investors can often borrow funds at significantly less than a property’s Cap rate, thereby amplifying the investor’s return on equity.

Thanks for reading the above blog post! We hope you found it enjoyable and educational. For updates on new blog posts, you can follow our blog and like our facebook page.

Also, Behind the Deals is seeking volunteer writers to research and analyze real estate deals. This could be a great opportunity for anyone that is passionate about real estate to learn about real estate investing, and most importantly a great way to give back to a community of both aspiring and experienced real estate professionals. Please email behindthedeals@gmail.com for more information.

Additional Sources and Interviews

https://www.sec.gov/Archives/edgar/data/1687229/000119312517004519/d260125ds11.htm

http://www.reuters.com/article/us-blackstone-group-realestate-idUSKBN0MQ21O20150330

https://www.wsj.com/articles/invitation-homes-prices-ipo-at-20-a-share-1485901804

http://www.housingwire.com/articles/39026-blackstones-invitation-homes-prepares-15-billion-ipo

This analysis was utterly brilliant. Thank you very much for unpacking this deal and shedding light on this industry.

LikeLike

Thank you for the kind words! Very much appreciated

LikeLike

Pingback: The New “Supply-Side Economics” Fueling Asset Bubbles | Global Macro Monitor

Pingback: The New "Supply-Side Economics" Fueling Asset Bubbles | ValuBit News

Pingback: The New “Supply-Side Economics” Fueling Asset Bubbles | ProTradingResearch

Pingback: The New “Supply-Side Economics” Fueling Asset Bubbles | Wall Street Karma

I have checked your blog and i’ve found some duplicate content, that’s why you don’t rank high in google, but there is a tool that can help you to create 100% unique articles, search for; Boorfe’s tips unlimited content

LikeLike

Pingback: The Story and Lessons Behind Invitation Homes: Blackstone’s Acquisition of 50,000 Single Family Homes for $10 Billion Between 2012 and 2016 | Program Realty

Pingback: Newsflash: The Story and Lessons Behind Invitation Homes: Blackstone’s Acquisition of 50,000 Single Family Homes for $10 Billion Between 2012 and 2016 – Majeed Ekbal's Daily Blog

Nicely done! A minor point I noticed, though: The first paragraph under “Background” mistakenly refers to a 25% LTV ratio. It should read 75% LTV due to the 25% down payment they placed while financing 75% of the purchase price, as you described later.

LikeLike

Great breakdown of the market factors! I am a 20-year real estate investor and the analysis of each piece of the business was excellent! Great job!

LikeLike

Excellent analysis! Looking forward to new content.

LikeLike